In the world of forex trading, timing is everything. The forex market operates 24 hours a day, five days a week, allowing traders from all over the globe to buy and sell currencies at their convenience. However, not every hour in the forex market is equally profitable. Understanding forex trading time zones and the best times to trade can significantly impact a trader’s success. For those looking for reliable platforms, forex trading time Trading Broker KH offers a robust solution for traders of all levels.

Forex Market Overview

The forex market is unique compared to other financial markets due to its 24-hour operation. It comprises three major trading sessions: the Asian session, the European session, and the North American session. Each session has its own characteristics, volatility, and trading opportunities.

The Asian Session

The Asian trading session kicks off the forex market each day, starting at 00:00 GMT and running until 09:00 GMT. This session is dominated by currency pairs involving the Japanese yen (JPY) and the Australian dollar (AUD). Trading during this time can be less volatile, but it presents opportunities for traders who focus on yen pairs.

The European Session

Following the Asian session, the European trading session begins at 08:00 GMT and continues until 17:00 GMT. This is the most active trading session, primarily because of the high volume of economic activity in Europe. The euro (EUR) and British pound (GBP) are frequently traded currencies during this session. The overlap between the Asian and European sessions from 08:00 to 09:00 GMT is often characterized by increased market activity.

The North American Session

The North American trading session runs from 13:00 GMT to 22:00 GMT and features currencies such as the US dollar (USD). This session overlaps with the European session from 13:00 to 17:00 GMT, creating heightened volatility and trading opportunities. Many traders look to take advantage of this overlap for potential breakout trades.

Understanding Overlaps

One of the keys to successful forex trading is understanding the overlaps between trading sessions. During these overlap hours, trading volume increases dramatically, resulting in higher volatility. These overlaps include:

- Asian/European Overlap: From 08:00 to 09:00 GMT, traders may experience some movement as liquidity starts to increase.

- European/North American Overlap: From 13:00 to 17:00 GMT, traders will find the highest activity level, with significant price movements and greater opportunities for profitable trades.

Best Times to Trade

To maximize trading potential, traders should focus on the hours when market overlaps occur. Here are some general guidelines to follow:

- Trade during the European and North American overlap to capitalize on major market movements.

- Avoid trading during off-hours when liquidity is low, as it may result in poor trade execution and reduced opportunities.

- Consider economic news releases; moments just before or after significant news can cause high volatility and opportune trade setups.

Developing a Trading Plan

To harness the best forex trading times effectively, traders should develop a comprehensive trading plan. This plan should outline specific trading hours, currency pairs to focus on, and risk management strategies. A well-defined plan helps to align your trading activity with the market’s rhythm, allowing you to make informed decisions.

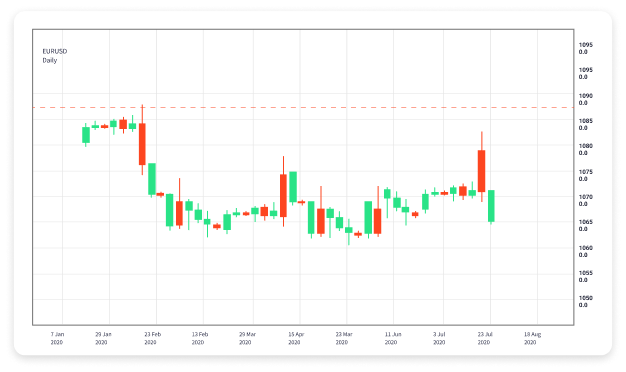

Identifying Currency Pairs

Choosing the right currency pairs to trade at specific times can increase chances of success. For instance, during the Asian session, focus on pairs like USD/JPY and AUD/JPY. Meanwhile, during the European session, consider trading EUR/USD and GBP/USD, and during the North American session, look towards USD/CAD and USD/CHF.

Final Thoughts

Forex trading requires not only skill but also strategic timing. By understanding the Forex trading hours and their overlaps, traders can greatly enhance their potential for profit. Continuous education, market analysis, and reflecting on trading experiences play significant roles in a trader’s growth. Remember to remain disciplined, stick to your trading plan, and use the best times to trade as a guide to navigate the complex world of forex trading successfully.

Leave a Reply

Want to join the discussion?Feel free to contribute!